rhode island state tax rate

Rhode Island has a graduated individual income tax with rates ranging from 375 percent to 599 percent. Customize using your filing status deductions exemptions and more.

Visualizing Unequal State Tax Burdens Across America Visualizing Unequal State Tax Burdens Across America What Percentage Of State Tax Finance Function Tax

The latest sales tax rates for cities in Rhode Island RI state.

. 2022 Filing Season FAQs - February 1 2022. Employers will be notified in late December of their individual tax rate. Latest Tax News.

If the customer is the State of Rhode Island a RI municipality or the Federal. Instead if your taxable income. 3 West Greenwich - Vacant land taxed at.

The rates range from 375 to 599. 2020 rates included for use while preparing your income tax deduction. Detailed Rhode Island state income tax rates and brackets are available.

The estate tax threshold for Rhode Island is 1648611. The Rhode Island income tax has three tax brackets with a maximum marginal income tax of 599 as of 2022. The Rhode Island tax is based on federal adjusted gross income subject to modification.

Rhode Island State Personal Income Tax Rates and Thresholds in 2022. Understanding Bare Root Plants. 2022 IFTA Return Filing Guidance - April 26 2022.

In addition to sales tax Rhode Island has an excise tax. 2989 - two to five family residences. This goes for sellers who call Rhode Island their home state and sellers who live and operate.

The current state sales tax rate in Rhode Island RI is 7. PPP loan forgiveness - forms FAQs guidance. Tax rates have been rounded to two decimal places in Coventry and North Smithfield.

Rhode Island Income Tax Rate 2020 - 2021. Besides the state income tax The Ocean State. Find out how much youll pay in Rhode Island state income taxes given your annual income.

The Rhode Island State Tax Tables for 2020 displayed on this page are provided in support of the 2020 US Tax Calculator and the dedicated 2020 Rhode Island State Tax Calculator. 2022 New Employer Rate. Rhode Island state income tax rate table for the 2020 - 2021 filing season has three income tax brackets with RI tax rates of 375.

That means that you charge the 7 Rhode Island sales tax rate to every buyer in Rhode Island. The Different Types of Roses. Rhode Island Tax Brackets Rhode Island uses a progressive tax system with three different tax brackets.

Form RI-1040 is the general income tax return for. Therefore the total tax on a gallon of gas in Rhode Island is 0534. The Rhode Island state sales tax rate is 7 and the average RI sales tax after local surtaxes is 7.

If it is worth more than that there is a. Rhode Island state sales tax rate. Rhode Island State Income Tax Forms for Tax Year 2021 Jan.

Rhode Island state sales tax rate. Rhode Island State Married Filing Jointly Filer Tax Rates Thresholds and Settings. 2022 IFTA Return Filing Guidance - April 26 2022.

The sales tax is imposed upon the retailer at the rate of 7 of the gross receipts from taxable sales. West Warwick taxes real property at four distinct rates. Growing Caring for Your Roses.

Exact tax amount may vary for different items. Details on how to. The Rhode Island Tax Rate Schedule is shown so you can see the tax rate that applies to all levels of taxable income.

Businesses that sell rent or lease taxable tangible personal. Rhode Island is one of the few states with a single statewide sales tax. The current tax forms and tables should be consulted for the current rate.

31 2021 can be e-Filed in conjunction with a IRS Income Tax Return. Rhode Island Income Tax Forms. The federal gas tax of 0184 per gallon also applies.

Less than 100000 use the Rhode Island Tax Table located on pages T-2. If your estate is worth less than that you owe nothing to the state of Rhode Island. Rhode Island is one of the few states having a single sales tax that applies to the entire state.

Care Handling and More. 2022 Rhode Island state sales tax. Rhode Island also has a 700 percent corporate income tax rate.

Rates include state county and city taxes. The tax breakdown can be found on the Rhode Island Department of Revenue website. The Rhode Island Tax Rate Schedule is shown so you can see the tax rate that applies to all levels of taxable income.

Rhode Island state property tax rate. The Rhode Island RI state sales tax rate is currently 7. DO NOT use to figure your Rhode Island tax.

Who Pays 5th Edition The Institute On Taxation And Economic Policy Itep Income Tax State Tax Low Taxes

Free Printable And Fillable 2019 Rhode Island Form Ri 1040 And 2019 Rhode Island Form Ri 1040 Instructions Booklet I Tax Forms Income Tax Return Google Scholar

The 37 States That Don T Tax Social Security Benefits The Motley Fool Tax Refund Social Security Benefits Income

States Where It S Easiest To Get Help Filing Taxes Smartasset Filing Taxes Online Taxes Tax Software

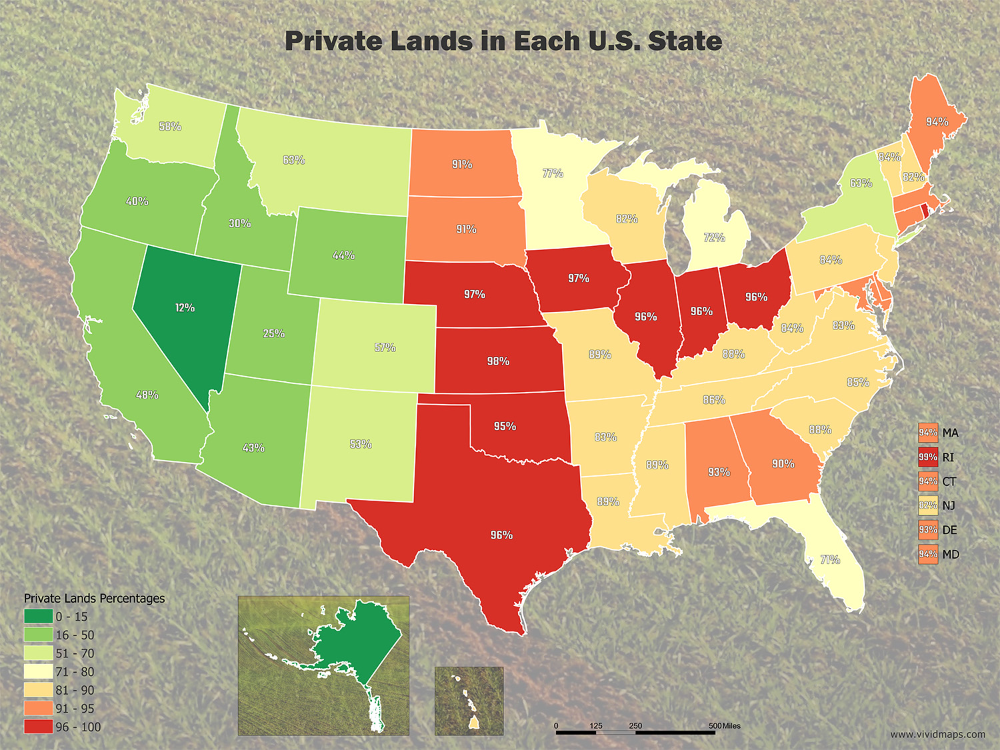

Value Of Private Land In The U S Mapped Vivid Maps Us Map Grand Canyon National Park Private

Portsmouth Rhode Island Real Estate Tax Rate 13 91 Per 1000 Click Photo To See Portsmouth Homes For Sale And To Rhode Island History Rhode Island Estate Tax

Rhode Island Property Tax Rate 1 5 Median Home Value 241 000 14th Highest Median Income 58 073 19th Highest Property Tax Property House Styles

Best Places To Retire To Make Your Retirement Income Go Farther Seeking Alpha Income Tax Retirement Income Income Tax Return

Benefit Street Providence Ri Providence Homes Rhode Island City Information

Pin By Visit Rhode Island On Art Culture In Rhode Island Rhode Island History Newport Rhode Island Rhode Island

How Much Cheaper It Is To Rent Than Buy A Home In Every U S State Vivid Maps Map United States Map Rent

When It Comes To 529s How Good Is Your State S Tax Benefit Morningstar College Savings Plans 529 College Savings Plan Savings Plan

Here Are The U S States With No Income Tax The Motley Fool Income Tax States In America Income

Are There Any States With No Property Tax In 2020 Free Investor Guide Property Tax States Small Towns Usa

Yes California Has The Highest Tax Revenue California Has Some Of He Highest Taxes But It Also Has The Family Money Saving Business Tax Economy Infographic

Bar Graph Showing That In States With No Income Tax The Poorest 20 Of People Pay More Of Their Income In Taxes Than In States Income Tax Graphing Bar Graphs